Mercedes-Benz Mobility AG

Siemensstr. 7

70469 Stuttgart

Deutschland

Tel.: +49 711 17 0

E-Mail: mobility@mercedes-benz.com

Represented by the Board of Management: Franz Reiner (Chairman), Gerrit-Michael Dülks, Jörg Lamparter, Susann Mayhead, Peter Zieringer

Chairman of the Supervisory Board: Harald Wilhelm

Commercial Register Stuttgart, No. HRB 737788

VAT registration number: DE 81 11 20 930

Please find here the interim reports from Mercedes-Benz Mobility (from 2022 on) and from the former Daimler Mobility AG (until 2021).

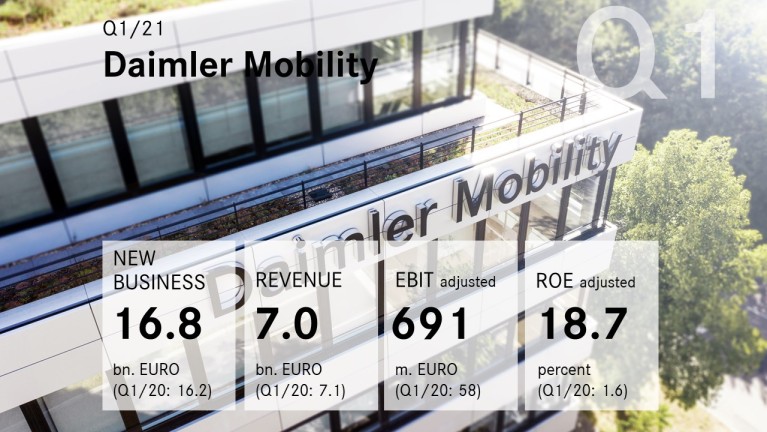

![[q1_1:MEDIASTORE_LEAF]@2ea20c8c](/images/mbm-relaunch/who-we-are/key-figures/q2-2023_ratio_16x9_s.jpg)

Mercedes-Benz Mobility tripled new business volume for BEVs (battery electric vehicles) to €1.8 billion (Q2 2022: €0.6 billion).

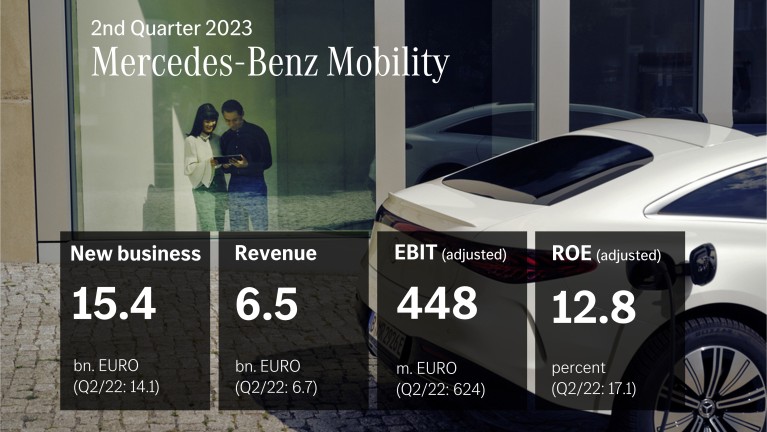

![[q1_2023:MEDIASTORE_LEAF]@25140e7a](/images/mbm-relaunch/who-we-are/key-figures/q1-2023_ratio_16x9_s.jpg)

Compared to the first quarter of the previous year, Mercedes-Benz Mobility was able to more than double the new business volume for BEVs (battery electric vehicles) to €1.2 billion (Q1 2022: €0.5 billion).

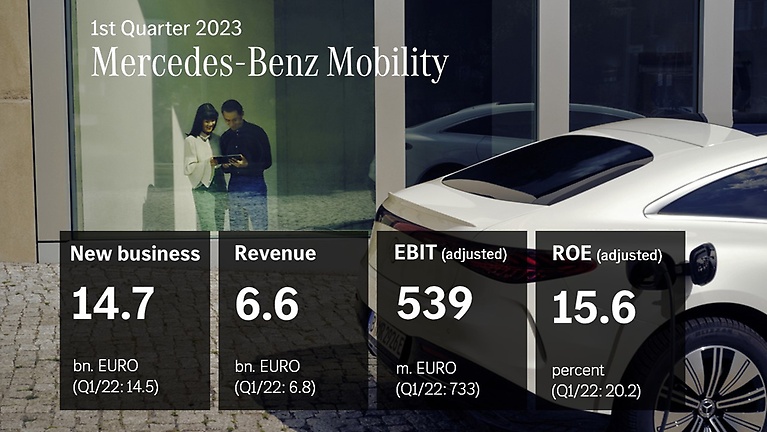

![[q3_2022:MEDIASTORE_LEAF]@6cdaf2fc](/images/mbm-relaunch/who-we-are/key-figures/q3-2022_ratio_16x9_s.jpg)

In the third quarter of 2022, Mercedes-Benz Mobility reached an adjusted Return on Equity (RoE) of 15.8%. The new business of Mercedes-Benz Mobility declined slightly by 3% to €14.3 billion compared to the prior-year’s quarter.

![[q2_2022:MEDIASTORE_LEAF]@72e9db17](/images/mbm-relaunch/who-we-are/key-figures/q2-2022/q2-2022_ratio_16x9_s.jpg)

The secondquarter of 2022 shows us that we can perform well even in a dynamic and challenging environment if we work attentively, work as a team and pull in the same direction.

![[mobility_q1_2022_teaser_v2_de:MEDIASTORE_LEAF]@5bd2e9d2](/bilder/mbm-relaunch/kennzahlen/q1-2022/mobility_q1-2022_teaser-v2_de_ratio_16x9_s.jpg)

The first quarter of 2022 shows us that we can perform well even in a dynamic and challenging environment if we work attentively, work as a team and pull in the same direction.

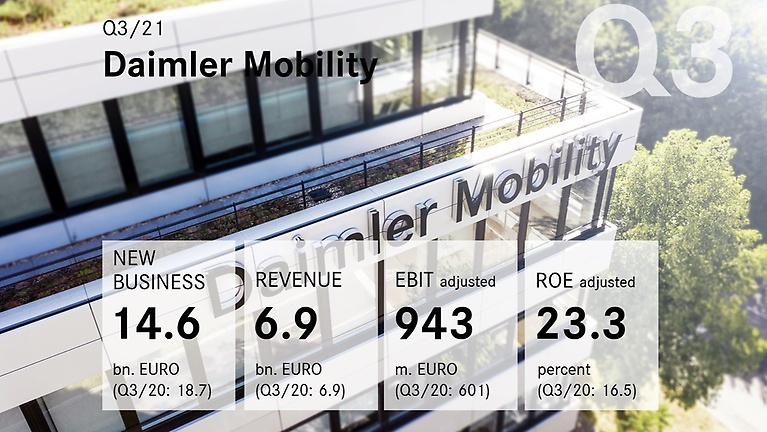

![[zwischenbericht_q3_1:MEDIASTORE_LEAF]@232a5209](/images/mbm-relaunch/who-we-are/key-figures/interim-report-q3-2021_ratio_16x9_s.jpg)

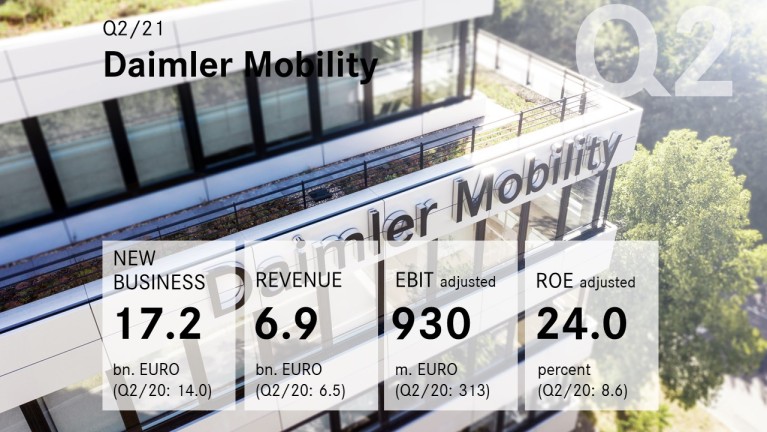

![[zwischenbericht_q2_2021:MEDIASTORE_LEAF]@6179fab1](/company/key-figures/interim-reports/q2-2021/interim-report-q2-2021_ratio_16x9_s.jpg)

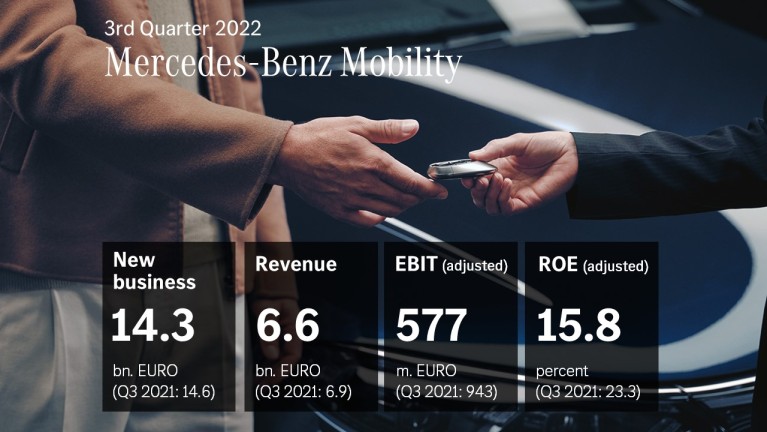

![[zwischenbericht_q1_2021:MEDIASTORE_LEAF]@15add2a9](/company/key-figures/interim-reports/q1-2021/interim-report-q1-2021_ratio_16x9_s.jpg)